vermont income tax brackets

If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

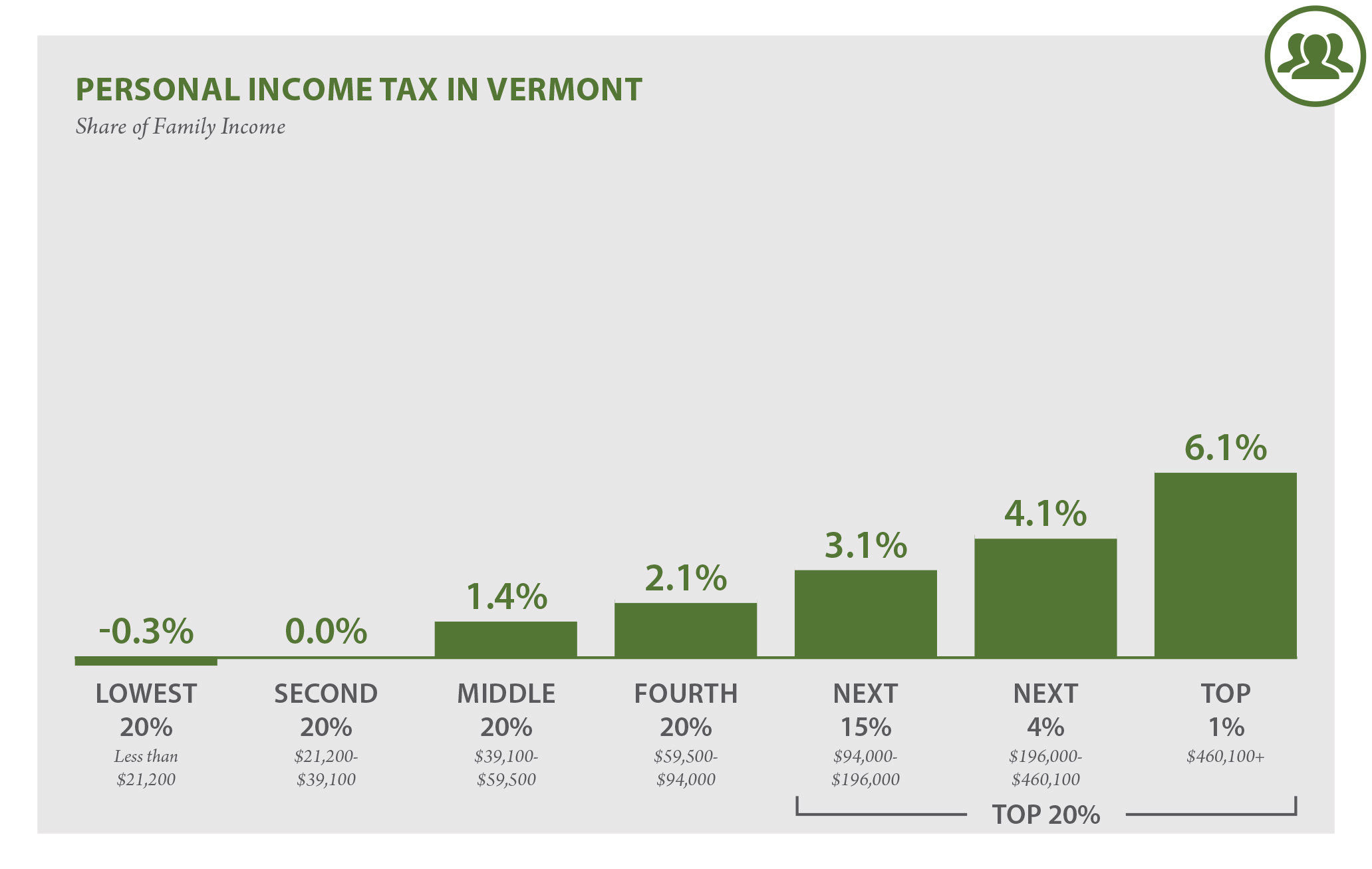

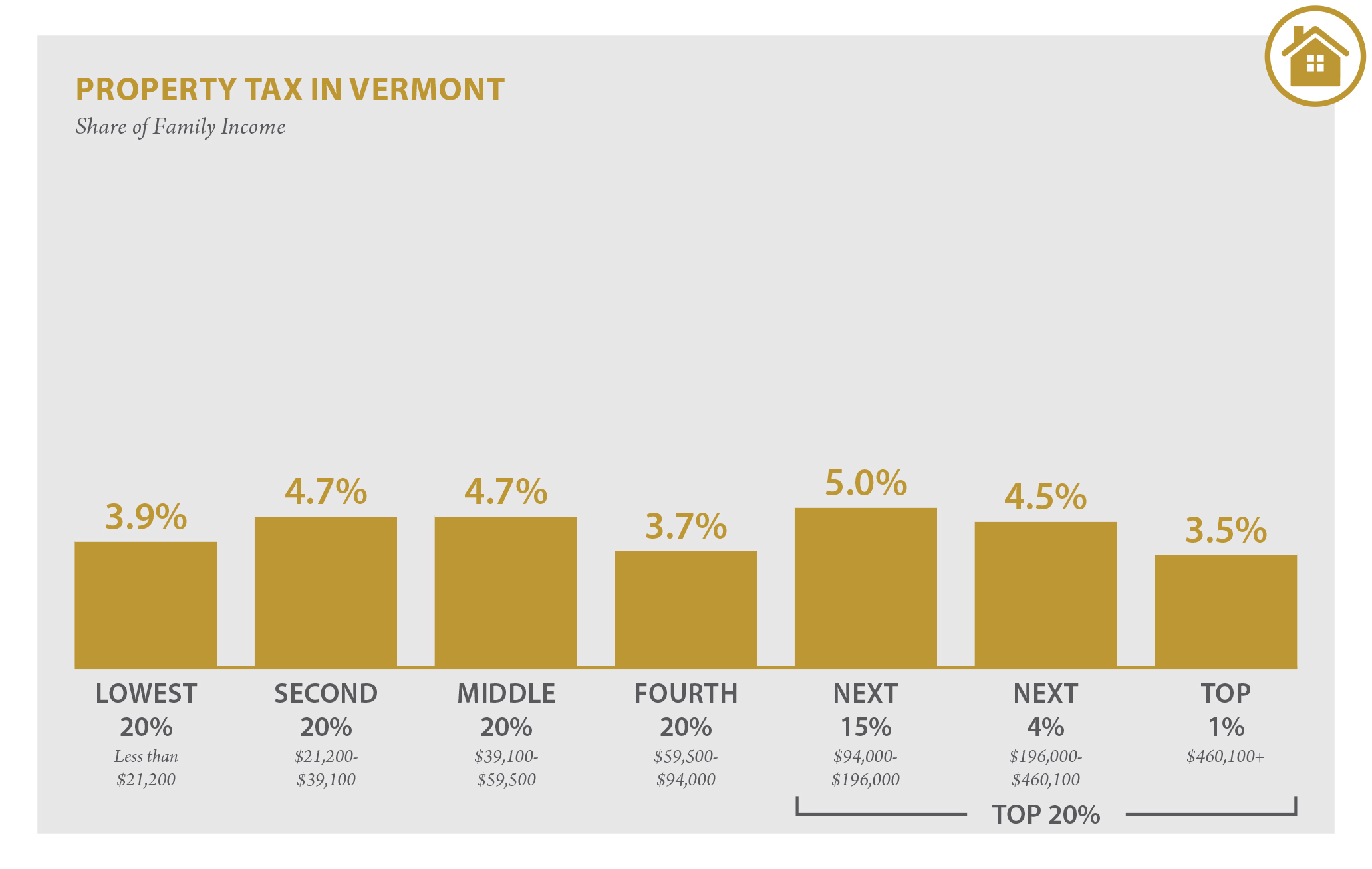

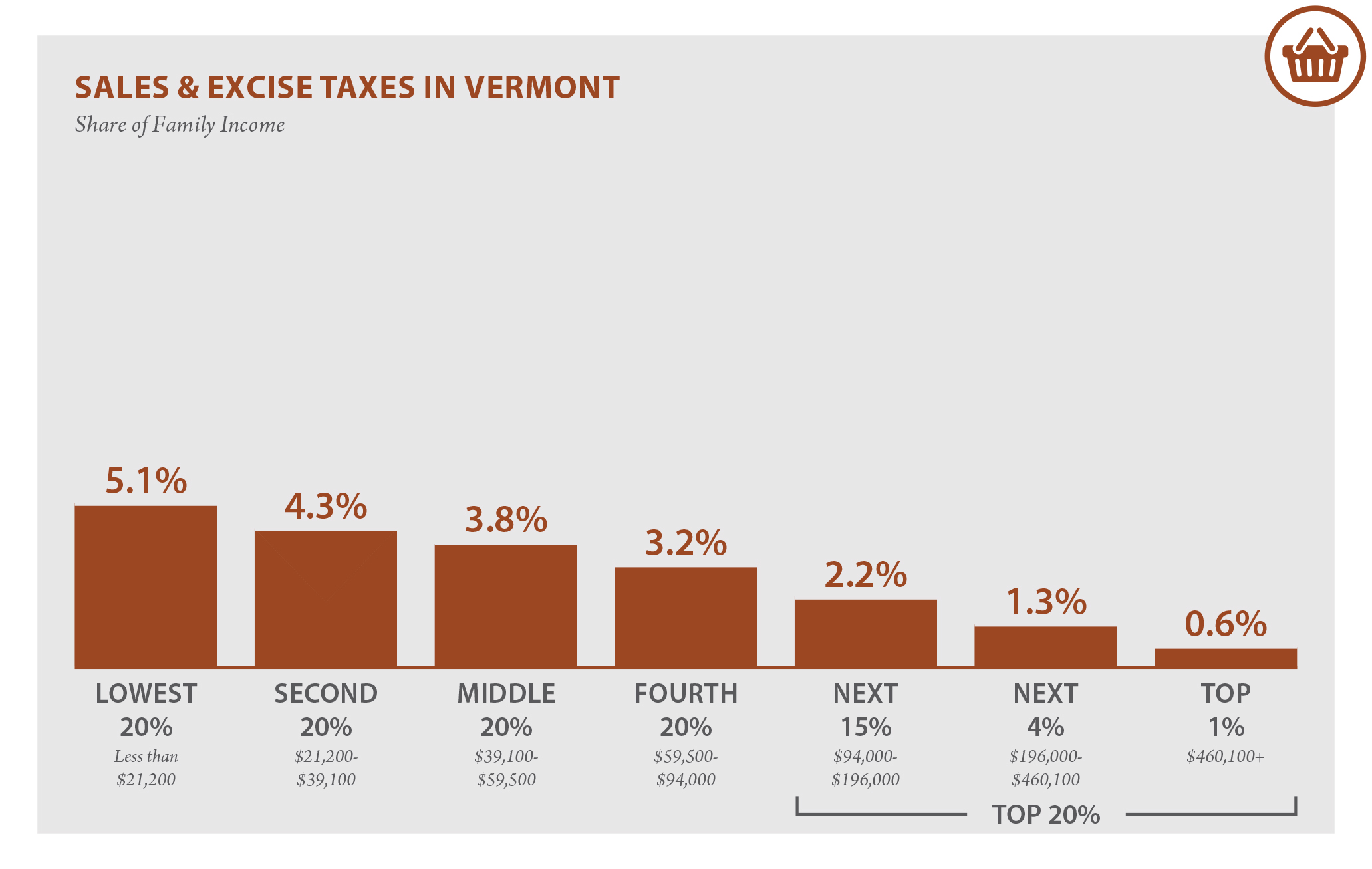

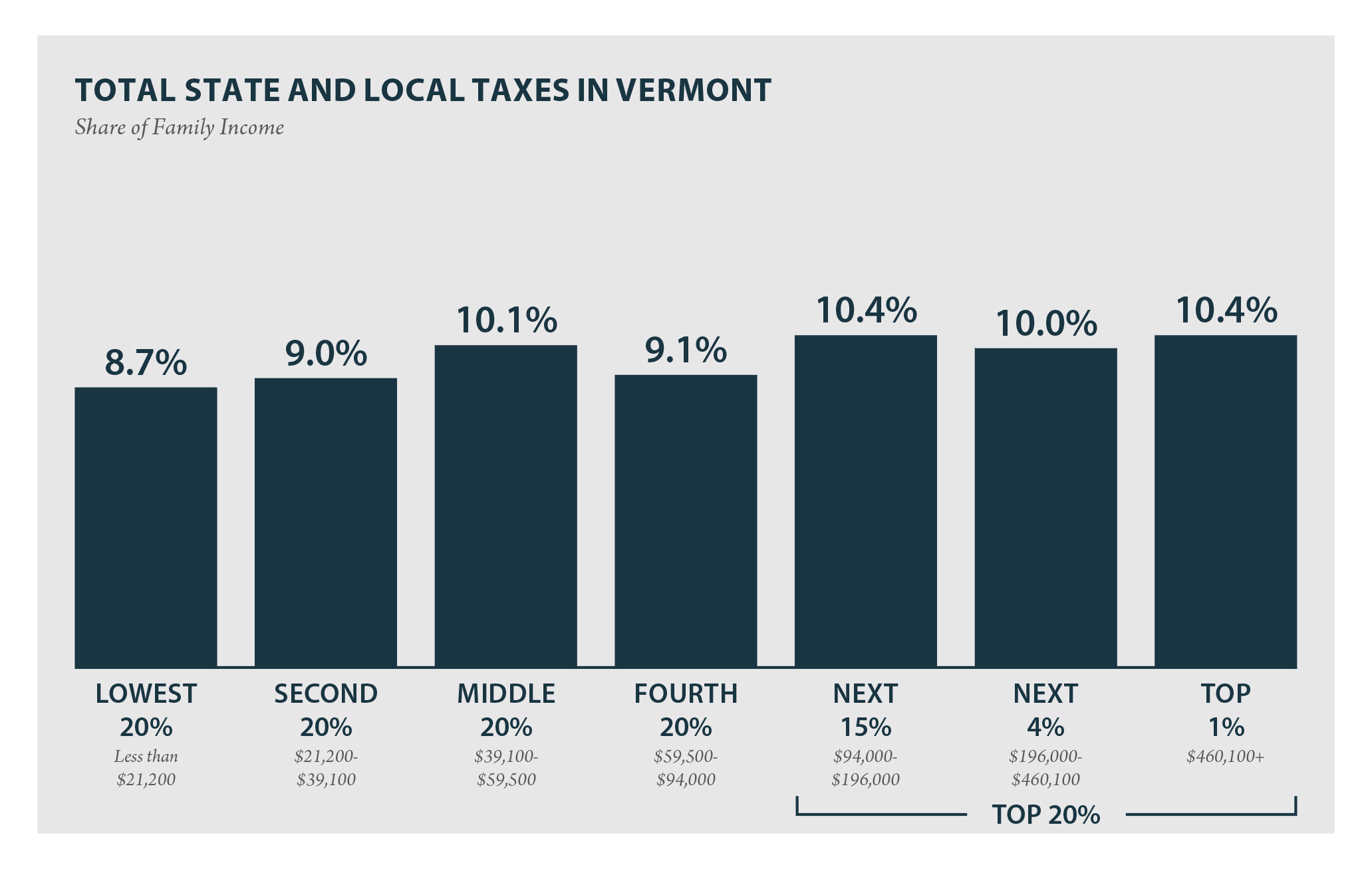

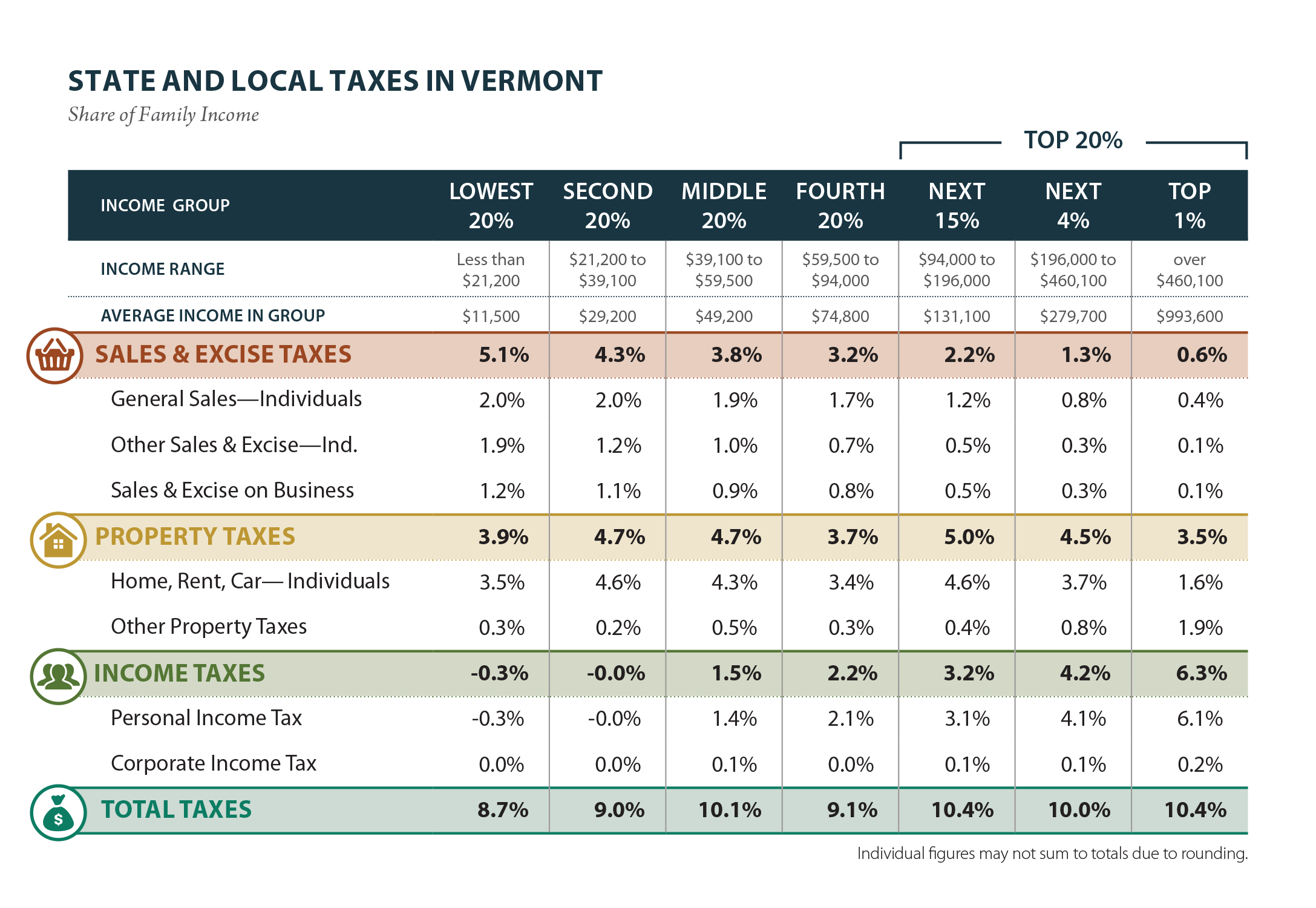

Vermont Who Pays 6th Edition Itep

More about the Vermont Tax Rate Schedules.

. W-4VT Employees Withholding Allowance Certificate. The tax brackets are different depending on your filing status. Here is a list of current state tax rates.

Vermonts 2022 income tax ranges from 335 to 875. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. Tax Rates and Charts Mon 03012021 - 1200.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. IN-111 Vermont Income Tax Return. 40351 - 9780067451 - 163000.

Vermont State Personal Income Tax Rates and Thresholds in 2022. Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermonts income tax brackets were last changed one year prior to 2003 for tax year 2002 and the tax rates have not been changed since at least 2001. Both Vermonts tax brackets and the associated tax rates were last changed one year prior to 2006 in 2005.

Base Tax is of 3189. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Vermont School District Codes. Discover Helpful Information And Resources On Taxes From AARP. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent.

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis.

As you can see your Vermont income is taxed at different rates within the given tax brackets. The latest available tax rates are for 2020 and the Vermont income tax brackets have been changed since 2002. Enter 3189 on Form IN-111 Line 8.

RateSched-2021pdf 3251 KB File Format. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Vermont Income Tax Brackets and Other Information.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. Vermont based on relative income and earningsVermont state income taxes are listed below. Your average tax rate is 1198 and your marginal tax rate is 22.

This form is for income earned in tax year 2021 with tax returns due in April 2022. The Vermont tax rate is unchanged from last year however the income tax brackets. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

2020 VT Tax Tables. Vermont also has a 600 percent to 85 percent corporate income tax rate. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Vermont School District Codes. Ad Compare Your 2022 Tax Bracket vs. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. In addition to the Vermont corporate income tax Vermont corporations must also pay the federal corporate income tax. Income tax brackets are required state taxes in.

IN-111 Vermont Income Tax Return. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Vermont State Personal Income Tax Rates and Thresholds in 2022.

Tax Year 2021 Personal Income Tax - VT Rate Schedules. Rates range from 335 to 875. PA-1 Special Power of Attorney.

2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Income tax tables and other tax information is sourced from the Vermont Department of Taxes. Vermont Income Tax Rate 2020 - 2021.

The table below shows rates and brackets for the four main filing statuses in Vermont. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

W-4VT Employees Withholding Allowance Certificate. VT Taxable Income is 82000 Form IN-111 Line 7. The Vermont Single filing status tax brackets are shown in the table below.

FY2022 Education Property Tax Rates as of August 18 2021. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. In addition check out your federal tax rate.

Filing Status is Married Filing Jointly. The state income tax system in Vermont is a progressive tax system. 2016 VT Rate Schedules and Tax Tables.

Vermont Tax Brackets for Tax Year 2020. For more information about the income tax in these states visit the Vermont and Florida income tax pages. Your 2021 Tax Bracket To See Whats Been Adjusted.

PA-1 Special Power of Attorney. Tax Rates and Charts Tuesday January 25 2022 - 1200. The major types of local taxes collected in Vermont include income property and sales taxes.

Like the personal income tax the federal business tax is bracketed based on income level. This tool compares the tax brackets for single individuals in each state. The Vermont Head of Household filing status tax brackets are shown in the table below.

Tax Rate Single Married. 2017-2018 Income Tax Withholding Instructions Tables and Charts. For income taxes in all fifty states see the income tax by state.

For an in-depth comparison try using our federal and state income tax calculator. More about the Vermont Tax Tables. Vermont Income Tax Calculator 2021.

This means that these brackets applied to all income earned in 2005 and the tax return that uses these tax rates was due in April 2006. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of. 0 - 403500 - 6745066.

Historical Vermont Tax Policy Information Ballotpedia

The Most And Least Tax Friendly Us States

Effective State Income Tax Map Public Assets Institute

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine